The housing market may be recovering, as many experts suggest, but investors are still struggling to understand what taxes they will owe upon selling their homes.

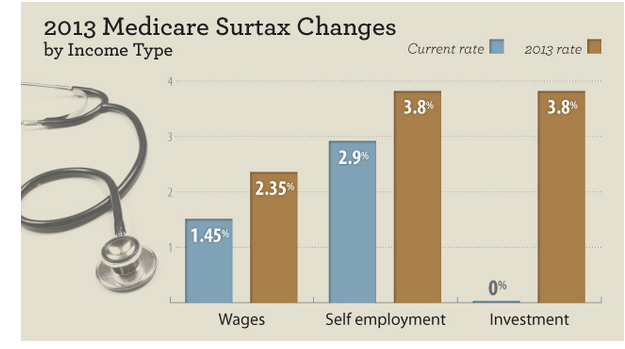

The Patient Protection and Affordable Care Act will affect those who hold rental income properties and vacation homes starting in Jan 2013. “Unearned income” will be subject to a new 3.8 % tax. What is unearned income? Bond interest, dividends from stocks, royalties, capital gains from selling investments at a profit, and income from rental property are all examples of unearned income.

Therefore, rental owners who have built substantial equity may see strong incentives to sell in 2012 before the new changes take effect. There are a few exceptions to this strategy:

If you give long term capital property to charity, you will avoid the capital gains tax; and,

If you hold appreciated stock until death, you may avoid the capital gains tax entirely.

There are many different scenarios, and your decision should be based on your specific situation. You must consult with your tax adviser to understand how this may affect you. However, higher unearned income taxes combined with higher expected capital gains taxes could make 2012, a good time to sell rental properties than in recent previous years.

Determining whether you will be subject to the tax can be complicated, and we encourage your clients to consult with competent tax professionals.